It’s often said that online marketplaces or multi-sided platforms are the dominant business model in today’s digital economy. These platforms (e.g., Amazon, Uber, Airbnb, Ebay, Facebook) facilitate interactions between various producers & consumers by aggregating supply & demand and laying out rules of engagement between them. At its core, the online marketplace/platform business model allows different segments to interact with each other and create & exchange value.

In the world of ridesharing for instance, Uber aggregates drivers and riders on its platform, allowing both to easily interact & exchange value under guidelines put in place by Uber. And in online retail, Ebay’s platform aggregates sellers & buyers, again allowing both to interact & exchange value. By reducing market fragmentation and attendant transaction costs, and by providing infrastructure and governance/oversight mechanisms that encourage participants to interact, platforms are able to create markets of enormous scale and efficiency.

In a heralded blog post (from 2012), Bill Gurley, the renowned venture capitalist at Benchmark Capital (and current or former board member of several leading US platform businesses including Uber, OpenTable, Zillow, and GrubHub) laid out ten factors that contribute to the success of online marketplaces/platforms. Of particular interest here is his description of the potential for platforms in highly fragmented markets:

High buyer and supplier fragmentation is a huge positive for an online marketplace[/platform]. Likewise, a concentrated supplier (or purchaser) base greatly diminishes the likelihood of a successful online [platform].

A highly concentrated supplier base will be reluctant to allow a new intermediary in their market, and as a result will likely fight rather than support your arrival. They will also be very reluctant to share in the economics of the industry…

If you look at the list of successful Benchmark investments, you will see a common theme of fragmented supplier bases.

For innovators in Africa, the good news is that this theme of fragmentation runs through various industries across the continent.

Compared to global counterparts, African companies by-and-large have yet to achieve significant scale, making highly concentrated markets less likely. In addition, the varying regulatory, cultural, and business contexts of the 54 countries that comprise Africa also present a hurdle firms must overcome to achieving meaningful pan-African consolidation in any given industry. Indeed, Africa is described as having a “fragmented retail and wholesale landscape,” a fragmented agricultural industry, fragmented logistics, and more. Acha Leke, McKinsey & Company‘s senior partner based in Johannesburg, describes Africa’s private sector on the whole as “relatively fragmented.”

While such fragmentation creates various problems for both consumers & producers across Africa, it presents an opportunity for innovators to create and capture value by developing platforms and marketplaces that organize markets and introduce efficiencies.

Fintech, Fragmentation, & Flutterwave

Across Africa over the last several years, the financial technology sector, or “FinTech”, is arguably receiving the greatest interest from innovators. Reports from Disrupt Africa and Partech Ventures estimate African fintech startups to have raised between $30-70 million in 2016, approximately 19-24% of total funds raised across all sectors. (South Africa’s Zoona, which operates in several African countries, alone raised a $15 million Series B round in Q3.)

Globally, FinTech’s digital payments sub-vertical made up “by far the biggest share of the total fintech market” in 2016 and continues to receive great attention from investors and entrepreneurs. However, certain global markets are characterized by consolidation & dominance within the digital payments ecosystem (rather than fragmentation) which, while providing benefits for both consumers & merchants, leaves smaller windows of opportunity for upstart innovators.

China is a noteworthy example of such a market where dominant digital payment players limit the opportunity for new entrants. In an interview with Knowledge @ Wharton, George Hongchoy, the CEO of Link Asset Management Ltd. (the parent company of the the largest REIT in Asia) sheds light on China’s payments landscape:

Most of the consumers in China either use Alipay or WeChat Pay. And having only one or two, or very few payment solutions [helps] shoppers because they don’t have to open their wallet and choose from 10 different ones, and think “which one should I use this time?” On the flipside, merchants also do not have to install that many options… So, having fewer payment solutions [helps].

Speaking generally, Africa’s payment landscape is on the other end of the spectrum, with highly pronounced levels of fragmentation. Ameya Upadhyay, a principal on Omidyar Networks’ investment team describes the situation:

In Africa, merchants and the financial institutions which serve them are hamstrung because the digital payment ecosystem is heavily fragmented. Compared to the widespread card acceptance in developed markets, less than 1 percent of the $380 billion in non-cash payments in Africa are made through cards. In fact, Africa is a maze of more than 276 mobile wallets, more than 500 banks, and 12 card networks in 54 countries.

This forces merchants to integrate with multiple payment service providers (PSPs) and banks to accept payments across the board, which is too expensive for all but the largest businesses. Even then, transactions can take days to clear, and merchants incur fees accepting payments or when withdrawing or transferring money. This encourages them to default to cash.

Because merchants’ acceptance of payment methods is limited and fragmented, so is the utility of consumers’ digital accounts.

As described above, the level of fragmentation within Africa’s digital payments ecosystem presents a tremendous opportunity for innovative players to develop platforms that reduce fragmentation, transaction costs, and inefficiencies. One firm seizing that opportunity is Nigeria’s Flutterwave.

How Flutterwave creates value by reducing fragmentation in Africa’s digital payment landscape

Founded in 2016, Flutterwave is enjoying considerable traction. It processed over $200 million worth of transactions within its first 8 months of operations; it’s one of the relatively few African startups to be accepted into Y Combinator, the prestigious US tech incubator; and it has raised funds from a select group of early-stage investors including Omidyar Networks, CRE Venture Capital, Golden Palm Investments, Green Visor Capital, and Cactus Capital. Moreover, in less than a year since launch, the company’s digital payments offerings are active in over 30 countries across Africa.

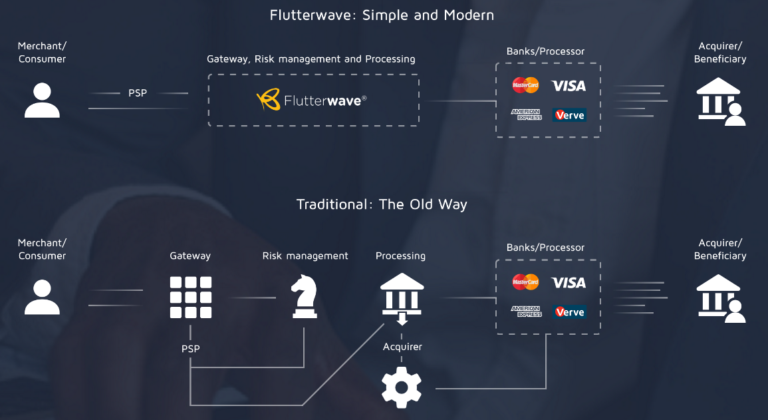

Flutterwave is a payment processing technology company that provides an API which allows partners to process credit card & local alternative payments (like mobile money and bank ACH). Or said differently, Flutterwave acts as an API-driven platform that aggregates payment gateways across Africa and the world on the one hand, and merchants and payment service providers on the other, allowing both sides of its platform to interact & exchange value.

Flutterwave’s Founder, Iyin ‘E’ Aboyeji describes the platform’s value:

We created a middle layer that payment service providers (PSPs) and global merchants can integrate with that works across payment channels, methods, and local currencies in different African countries.

When merchants and payment service providers integrate with Flutterwave’s API, they are integrating all these different payment systems and methods simultaneously. Merchants and PSPs can disburse to and get paid from millions of cards, mobile money wallets, and bank accounts in several African countries almost immediately.

By reducing market fragmentation in Africa’s payment landscape and the attendant transaction costs, and by providing infrastructure and mechanisms that encourage merchants and PSPs to interact with payment gateways, Flutterwave has been able to build undeniable momentum, displaying strong potential to create a payments market of great scale and efficiency in the long run.

The Final Analysis

The potential for quickly achieving scale is a large part of why some business thinkers regard platforms as the pre-eminent business model in today’s economy. To achieve notable scale however, platforms have to solve real problems for both producers and consumers. Again, the good news for entrepreneurs and investors in Africa is that fragmented markets create significant pain points for market participants.

Given the levels of fragmentation within large swathes of Africa’s private sector, there remain sizeable opportunities for savvy innovators to deploy platform models to reduce fragmentation and unify markets.

If you enjoyed this article, subscribe to be notified when more like it are published.

Share: